CO₂ toll

Introduction of a CO₂-dependent toll from 1 January 2024

With an amendment to the Federal Road Toll Act and the ASFINAG Act, Austria is implementing the new EU Road Charging Directive.

From 1 January 2024, not only infrastructure costs and traffic-related costs due to air pollution and noise pollution will be included in the HGV toll, but also the vehicle's CO₂ emissions. The new pricing system for the mileage-based GO toll applies to vehicles with more than 3.5 tonnes of technically permissible total mass and will be introduced in stages from 2024 to 2026.

Changes to the tolling system

Since January 2024, there has been a CO₂-dependent toll for vehicles with a technically permissible total mass of more than 3.5 tonnes.

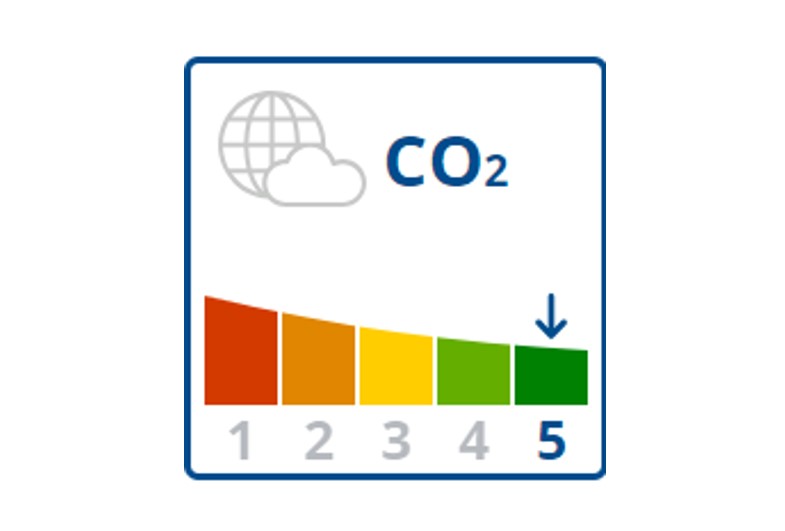

CO₂ emission classes

CO₂ emission classes are used to categorise vehicles and were introduced to reduce traffic-related CO₂ emissions and counteract environmental pollution.

There are five CO₂ emission classes, with CO₂ emission class 1 being the worst and CO₂ emission class 5 being the best. The toll rate therefore also depends on how much carbon dioxide (CO₂) your vehicle emits. Vehicles with a better CO₂ emission class pay less toll than vehicles with a worse CO₂ emission class.

No need for action for the majority of vehicles

For more than 95 percent of all vehicles of our existing customers, there will be no need for action. This is because all vehicles will initially be classified in CO₂ emission class 1.

Only vehicles with a proven E/H2 drive type (pure electric drive and hydrogen fuel cell drive) are automatically assigned to CO₂ emission class 5.

- Vehicles with a date of first registration before 1 July 2019 will automatically remain in CO₂ emission class 1 because they cannot be assigned to a higher emission class due to the legal requirements. The same applies to vehicles for which there are yet to be any legal regulations (buses, motorhomes and some heavy commercial vehicles – exception: zero-emission vehicles are assigned to CO₂ emission class 5). CO₂ emission class 1 is not subject to verification.

- For vehicles that were first registered after 1 July 2019, the correspondingly better CO₂ emission class can be determined by entering the corresponding values in the CO₂ emission class calculator. For these vehicles, it is possible to check a more favourable toll rate based on the CO₂ pricing.

The CO₂ emission class as well as the EURO emission class are not stored on the on-board unit but are taken into account centrally. The advantages are obvious: no separate visit to a GO point of sale is required for this; the processing and determination is conveniently carried out online. ASFINAG then automatically takes over the central processing once the verification has been completed.

You can download the current vehicle declaration at any time in the SelfCare portal or via the following query after identifying yourself by means of the personal identification number (PAN) and vehicle on-board unit identification number (OBU ID). You can also obtain the latest vehicle declaration from the GO point of sale.

CO₂ calculator

ASFINAG provides a customised service for determining the CO₂ emission class of the respective vehicles. With the CO₂ emission class calculator, you can determine the CO₂ emission class with just a few clicks.

Maximum technically permissible laden mass

New toll demarcation from 1 December 2023

With the implementation of the Directive 1999/62/EC (Eurovignette Directive), a new distinction is made between the distance-based lorry toll and the time-based car toll.

From 1 December 2023, the maximum technically permissible laden mass and no longer the maximum permissible gross weight will be decisive for the toll obligation.